Pre-onboarding validation

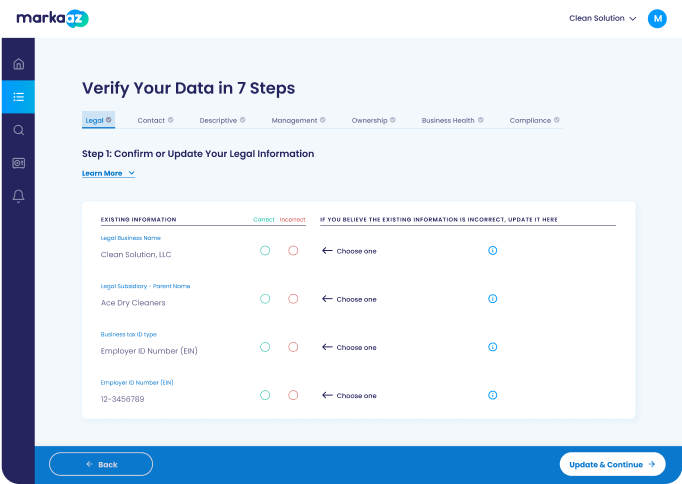

Ensure the accuracy and legitimacy of customer data through pre-application data verification.

Streamline document collection, including beneficial owner information.

Increase onboarding approvals, streamline the customer experience, and improve retention with a user-contributed data platform customized to your needs.

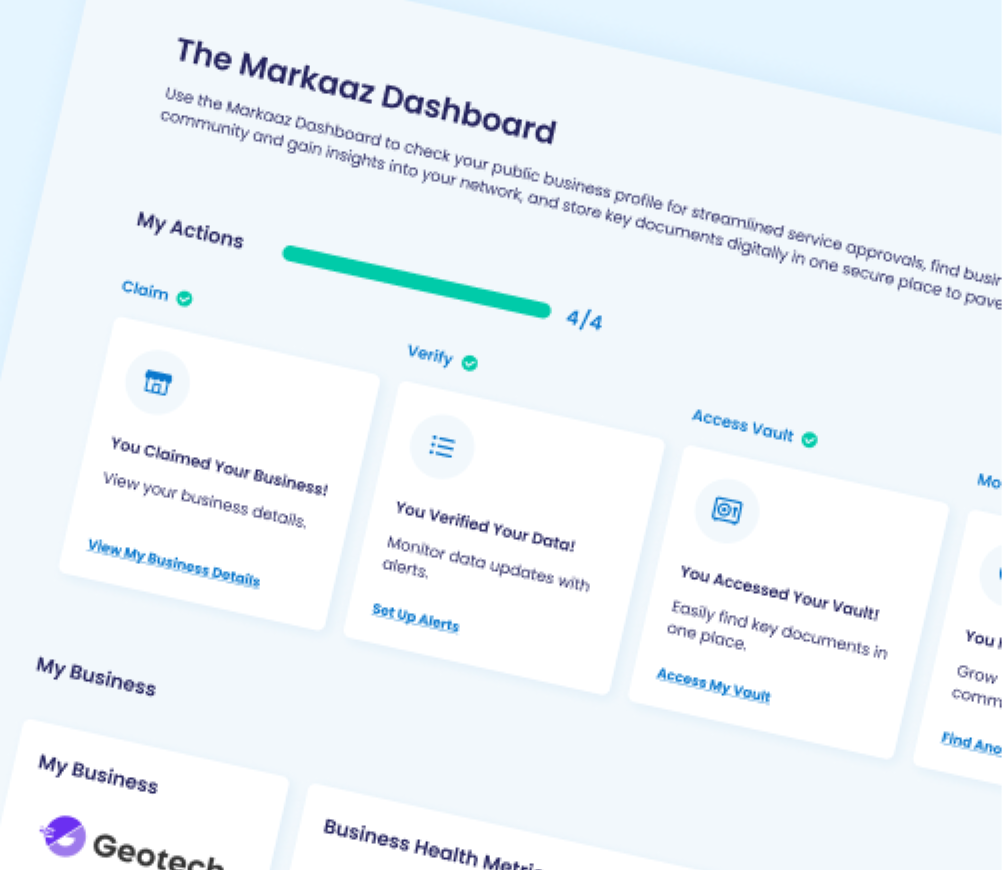

The Markaaz Dashboard is a digital data collection and management platform that empowers SMBs to actively

participate in the onboarding process, streamlining and improving data sharing for both SMBs and service providers.

Our team will white label a custom Dashboard to fit into your Know Your Business (KYB) processes and SMB offerings

across your full customer lifecycle.

Ensure the accuracy and legitimacy of customer data through pre-application data verification.

Streamline document collection, including beneficial owner information.

Address application errors directly with the SMB owner, avoiding communication delays.

Give a second look at ‘maybe’ applicants to capture more qualified candidates.

Incorporate the Markaaz Dashboard as a white-labeled, custom offering. With it, SMBs can:

Verify publicly available business data and store key documents in the Markaaz Vault for validation.

Monitor their business data, identify inaccuracies, set alerts for changes, and access guidance for updating and validating information.

Access business management tools for financial insights and document management.

Share your requirements with our team and explore how we can customize our SMB engagement solution to help you streamline onboarding, increase revenue, and lower risk.

Free Match Rate test

Markaaz verifies 30% more businesses than leading providers. See what you’re missing with our free match rate test.