Navigating the complexities of Know Your Business (KYB) regulatory requirements is no small feat, especially for enterprise compliance officers onboarding SMBs. While the overarching aim of KYB is to ensure alignment with legal and anti-money laundering (AML) standards and the process involves many important steps, it’s the verification step that often proves the most challenging.

Inconsistencies and unverifiable information not only cause bottlenecks but can also translate into missed opportunities and potential risks. As we delve deeper into the intricacies of SMB verification, we’ll examine the underlying challenges and explore how modern solutions, such as those offered by Markaaz, are changing the game.

The challenges of SMB verification

In addition to meeting KYB requirements, the business verification process impacts an enterprise’s bottom line. Many find that they are unable to verify 20-40% of potential small business customers using their current data sources.

A small business owner misses out on vital opportunities to access capital and other services when they can’t be verified. At the same time, enterprises take a hit to their bottom line, missing revenue opportunities by mistakenly rejecting legitimate businesses. There are two primary reasons why this happens: inconsistency and bad data.

Data inconsistencies

A significant hurdle in the KYB landscape is the inconsistency of data. With multiple sources, from official registrations to online directories, variations in a company’s details are almost inevitable. It’s common for SMBs to make simple mistakes that can cause the company’s information to vary across different platforms and sources, creating confusion and errors.

Consider the hypothetical case of Emily, a passionate baker, who starts her venture in Atlanta. She registers her business—Emily’s Exquisite Pastries—with the Georgia Secretary of State and is meticulous about her details. However, when she opens a branch in Savannah and lists her bakery in an online directory, a minor discrepancy—a typo in her street name—creates two different addresses for the same enterprise.

The challenge is further exacerbated because Emily’s Exquisite Pastries is the operating name, but Emily legally registered it under Emily’s Pastry Shop. Now, enterprises attempting to onboard Emily’s Exquisite Pastries face the daunting task of piecing together data that appears incongruent at first glance.

Bad data

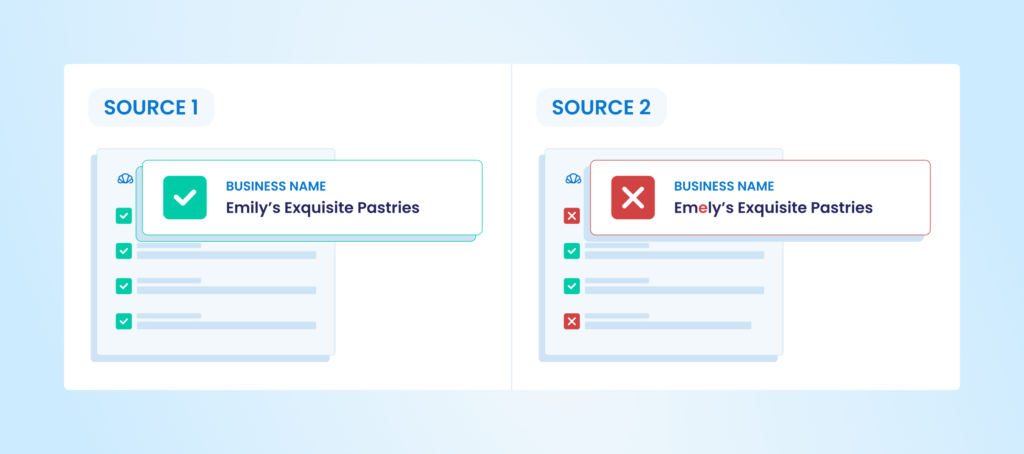

In addition to inconsistency, there’s also the challenge of bad data, minor errors that can escalate into major roadblocks. Simple misspellings or typographical errors can drastically affect the verification process. Using approximate string-matching techniques can help, but it isn’t flawless. To continue with our bakery example, if Emily had mistakenly registered her business as “Emely’s Exquisite Pastries” in one source, a direct match would fail, leaving enterprises skeptical about the authenticity of her business.

Consistency, in this context, transcends simple data accuracy. If an enterprise is searching for a particular version of a company’s name or address that doesn’t match the SMB’s input, the business verification process can grind to a halt.

Data matching and verification provider limitations

Enterprises using traditional business information solutions often hit roadblocks because of the provider’s data limitations. All too often, matches are being made against a small subset of name and address variations, using the provider’s single proprietary database. Older technology and coding also inhibit the process. This combination of factors often results in an inability to create high-quality matches 15-20% of the time.

Newer business identity companies offer more extensive results but may not provide high-confidence matches. The web-scraping technology used by many of these companies is also not legal in all countries, limiting the geographic scope of the search. Manual intervention is often required to identify the correct company, creating both speed and scale issues.

While the data mining and verification options for KYB compliance officers have previously been limited, Markaaz offers a better solution.

The Markaaz difference

Rather than just being another player in the arena, Markaaz offers a reimagined approach that addresses traditional pain points and sets new industry standards. The depth and breadth of data sources and advanced matching and verification techniques used by Markaaz set the process—and the results—far apart from the competition.

Comprehensive data sources

Markaaz harnesses the power of a vast array of data, integrating global premium sources, freely available public information, and data contributed directly by SMBs. This rich tapestry of information ensures that the data foundation is robust, diverse, and comprehensive, making the verification process more accurate and efficient.

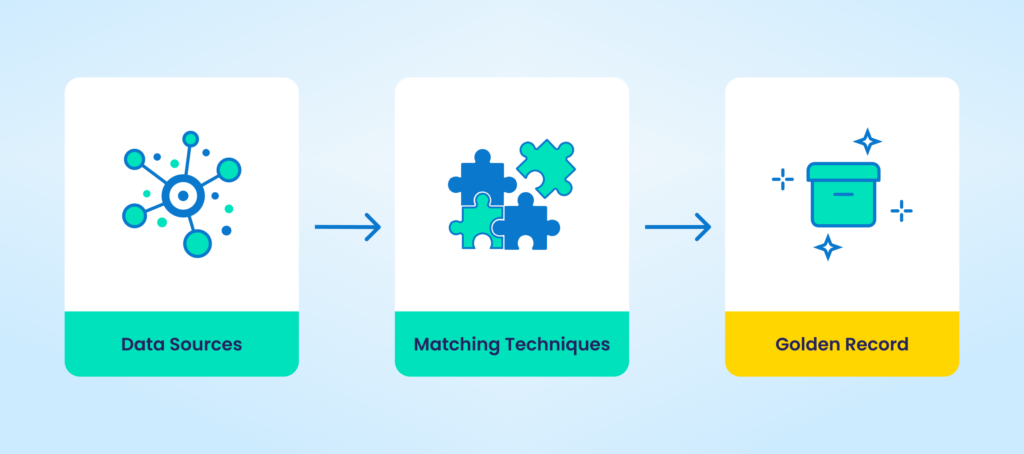

The Markaaz Golden Record

The Markaaz Golden Record represents the most accurate and holistic profile of a business. Instead of sifting through fragmented or inconsistent information from various sources, Markaaz aggregates the best data attributes and merges them into one cohesive business profile. This streamlines the verification process, minimizes errors, and ensures that enterprises have a dependable point of reference when making critical decisions.

Advanced matching techniques

With its state-of-the-art techniques, Markaaz goes beyond direct matches to account for the variations often seen in business data. The Markaaz proprietary platform uses 100% cloud-based technology, ensuring scalability and speed and offering efficient and effective results, even with massive datasets.

Markaaz’s matching algorithm is crafted by data experts and incorporates AI and machine learning (ML) so the algorithm constantly improves with each verification test, enhancing its ability to select the best and most accurate data elements to identify and validate even more small businesses.

Match by various attributes

The Markaaz matching algorithm understands that businesses can be identified by a range of attributes beyond names and addresses. From URLs to specific product offerings, utilizing a diverse set of identifiers ensures that even if one data point doesn’t align, others can be used to verify and validate the business.

Scoring and selection

Markaaz doesn’t merely offer matches; it scores them. Based on various criteria, each potential match is given a score, indicating its likelihood of accuracy. This scoring system, coupled with customization for specific use cases, allows enterprises to confidently select the best match.

Embrace the future of SMB verification

Gone are the days of tedious, error-prone verification processes. With Markaaz, enterprises have a powerful tool that not only simplifies KYB compliance but also ensures unmatched accuracy.

With comprehensive data sources, the creation of the Golden Record, and state-of-the-art matching techniques & strategies, Markaaz truly sets a new standard for SMB verification. The system delivers match rates of over 90%, giving enterprises access to more successful partnerships, better compliance, and minimized risks.

Don’t get left behind in a rapidly evolving business environment. Embrace the modern approach to SMB verification. Connect with our team and experience the difference today.