Markaaz, the Dashboard for small business management, has big plans for partnerships, growth, and expansion that enable customization, connectivity, and resource access.

Here at Markaaz, we are building a dashboard where our members can connect all of the small business tools they need to get a birds-eye view of their complete business operations. Today we help small business owners navigate the most important aspects of getting their business going. Tomorrow, we will be able to assist them throughout their business growth journey.

Markaaz works with companies and partners that provide small business management and financial advice, access to the best tools for running their business, discounts from verified and trusted global partners, and in the future, we will offer no-fee payments and much more.

To ensure our members have access to the best suppliers on the market today, Markaaz has a proprietary tracker of thousands of small business solutions that we continuously update and research to maintain a list of top small business tools and services. These include tools such as HubSpot and PayPal.

All of the small business finance solutions a company may need, from insurance to banking, loans, credit cards, and more, can be accessed through the Markaaz Dashboard. We are partnering with and establishing connectivity with Tier 1 banks, insurance brokers, credit card providers, and cyber-security experts. This will ensure our small business members have what they need at their fingertips.

For advice and resources, we are working with companies with outstanding community resources and building blocks to help small businesses grow and develop along their unique journey.

We also partner with small business-friendly banks, processors, and fintech platforms. We plan to enable no-fee payments and peace of mind for small business accounts payables and accounts receivables management.

Dashboard partnerships

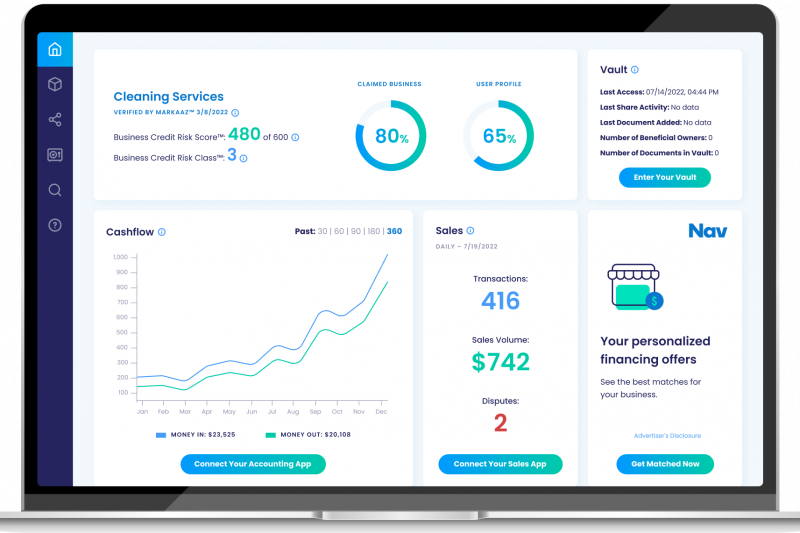

As part of Markaaz’s commitment to extend its offerings to its business members, it recently partnered with Nav, the fintech that facilitates transactions between data providers, lenders, partners, and small businesses.

This new partnership gives Markaaz Dashboard users access to Nav’s broad lender portfolio and positions Markaaz as the platform for all things small businesses and small business owners need to choose financing partners.

“Cash flow is an ongoing challenge for small businesses. As a small business, you are asked to pay bills up-front. Your customers may pay you late, but you still have to perform your service at the highest quality to be competitive in the market. This can be overwhelming and presents an ongoing dance between keeping your business running and ensuring its runway for the future. Many of the small businesses we serve have shared with us their worries about cash flow and access to capital. With our partner Nav, we can provide our small business customers with access to over 100 different financing options and ensure faster applications. This is powered by our digital interface that helps small businesses organize their data,” noted Fabi Hubschmid, Co-Founder & COO at Markaaz.

The Markaaz Vision

The vision for the Markaaz Dashboard is a persistent ‘on’ environment. Our platform will be the single screen that a business owner or entrepreneur keeps open all day, eliminating the need for 25 tabs open in their browser just to manage their business.

Markaaz’s future Dashboard roadmap includes:

Greater customization and connectivity within the Dashboard.

Soon, businesses will be able to receive their business insights, monitor their business credit and risk scores, and apply for all services they need from within the Dashboard through a carefully curated and growing list of service providers. The Dashboard aims to simplify the small business owner’s day and store the data they need to run their business more efficiently.

Greater guidance for new and long-term business owners.

Via new partnerships currently in motion, we can help all business owners using our Markaaz Dashboard to understand which documents, such as tax returns, accounting statements, etc., they might need for various purposes. These recommendations will be based on benchmarks from similar companies across similar industries and across their business lifecycle stages. Currently, Markaaz has its Vault, where these documents can be securely stored under secure encryption. Whether it’s your first business or your tenth, we will be able to empower you to start your success story and continue it with Markaaz.

Greater flexibility for how you pay and get paid.

We are partnering with small business-friendly banks, processors, and fintech to enable a platform where small businesses have a say in payments. This will include the ability to pay with different funding sources (not limited to cash and traditional payments) and to pay with the payment method that is best for the small business. This includes pooling together multiple sources of value like airline miles, multiple credit and debit cards, and bank balances. This is done confidentially and is decoupled from the payment preference of the person or business being paid. Further payments inside the Markaaz network will be free.

With our commitment to growing and developing your business from start to acquisition, we at Markaaz are your business life partners.

Join Markaaz now and let us help you grow your business better!