In the fast-growing fintech industry, compliance challenges—and the resulting penalties—are becoming a costly issue for many companies. A recent report revealed that 60% of financial technology firms paid at least $250,000 in compliance fines, with one-third facing penalties exceeding $500,000 in the past year. These figures highlight the increasing importance of anti-money laundering (AML) compliance in a sector that handles high volumes of cross-border transactions and cryptocurrency, both of which are particularly susceptible to financial crimes.

As fintech companies innovate and expand, they face increasing regulatory scrutiny due to gaps in traditional banking oversight and the rising threat of money laundering. To address this intense situation, companies must go beyond basic AML compliance and implement more robust systems to detect and report suspicious activity. By understanding the risks involved and taking proactive steps to stay compliant, fintech companies can minimize penalties and protect their reputations.

The Growing Scrutiny of Fintechs

Global regulatory bodies like the Financial Action Task Force (FATF) and national regulators are intensifying their focus on fintechs. By their nature, fintechs are exposed to higher risks due to their involvement in large volumes of digital transactions, including cross-border transactions, peer-to-peer transactions, and cryptocurrency—all of which make them more susceptible to money laundering.

Recent fines levied against fintech firms illustrate the consequences of failing to meet regulatory expectations. For instance, in 2022, crypto platform BitMEX was fined $100 million by the Commodity Futures Trading Commission (CFTC) and the Financial Crimes Enforcement Network (FinCEN) for inadequate AML controls and failing to report suspicious activity.

Similarly, Wirecard, once a fintech darling, collapsed after regulators uncovered significant gaps in its AML processes, leading to billions in fines and the eventual dismantling of the company.

The fallout from failing to meet anti-money laundering compliance regulations goes beyond financial penalties. The damage to a company’s reputation can be severe, as customers and business partners lose trust in firms that cannot guarantee the security of their financial transactions. For fintechs, whose value proposition often hinges on trust and innovation, this type of reputational damage can result in significant loss of business, partnerships, and ultimately market share.

Common AML Compliance Issues for Fintechs

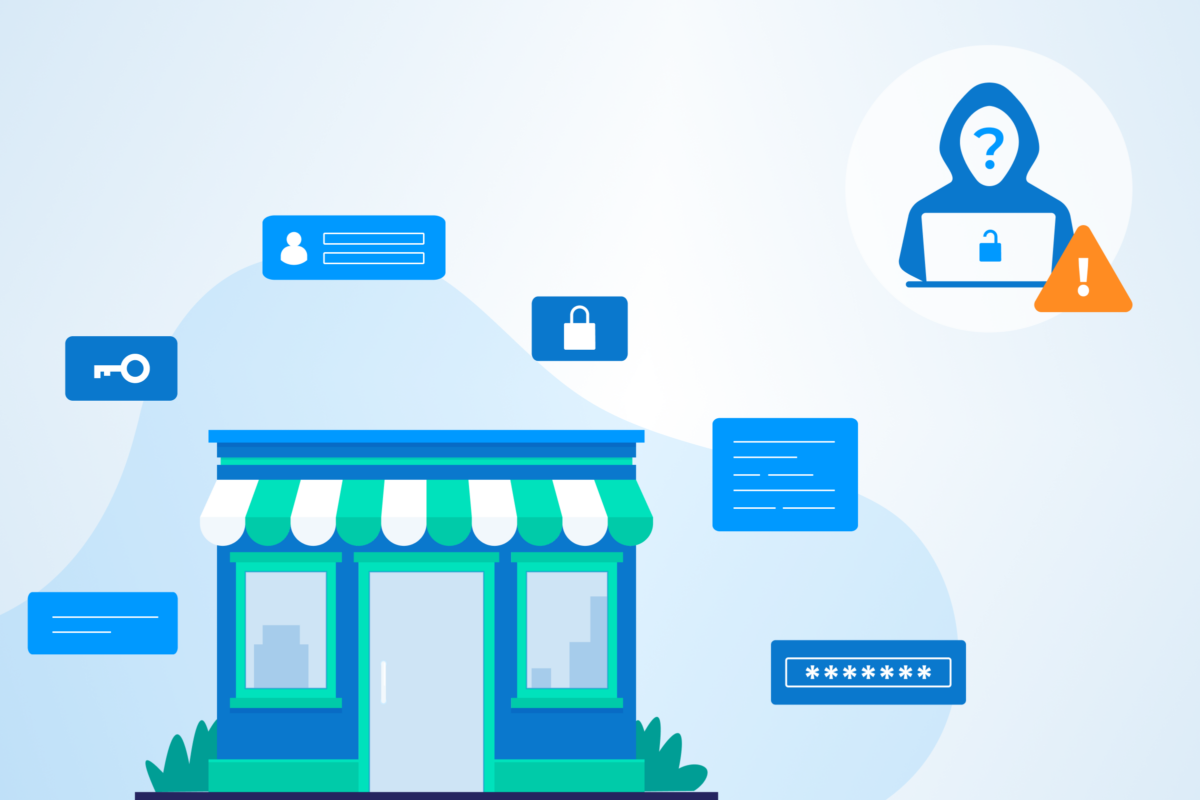

In the fintech industry, effective Know Your Business (KYB) practices are crucial to preventing money laundering and other financial crimes. KYB for fintechs serves as the first line of defense for fintechs by verifying the legitimacy of business clients and ensuring their operations are above board.

Without robust KYB systems, fintech companies face significant risks, as they may unwittingly facilitate financial crimes. Ensuring thorough and consistent KYB processes is key to AML compliance for fintechs, especially given the increasing complexity of business relationships in the digital age.

Real-Time Transaction Monitoring

Ongoing transaction monitoring for fintechs is also critical to detecting suspicious behavior in real time. Fintech AML solutions must be equipped to identify patterns of suspicious activity, so they can quickly and accurately flag transactions that may indicate money laundering or fraud.

Fintech companies are required to promptly report any suspicious activity. Delays in submitting suspicious activity reports (SARs) or providing incomplete reports can result in non-compliance, leading to heavy fines and reputational damage. This challenge is compounded for firms operating across multiple jurisdictions, where they must comply with varying fintech AML regulations and international standards.

Monitoring Cryptocurrency Transactions

Cryptocurrency transactions pose additional challenges, as the lack of standardized regulations across jurisdictions makes it difficult for fintechs to ensure compliance. The decentralized and anonymous nature of cryptocurrencies makes them attractive for illicit activities. Without clear guidelines, fintechs are left to navigate a patchwork of regulations.

Cross-Border Payments Compliance

The complexity of cross-border payments compliance remains a major hurdle for fintechs. Operating internationally means adhering to different regulatory frameworks in each country, often with conflicting requirements. Fintechs must stay up-to-date with international AML standards and ensure their systems are flexible enough to adapt to each jurisdiction’s regulations.

It’s clear that fintech compliance challenges extend beyond simple adherence to guidelines. To survive and thrive, firms must proactively implement robust AML fintech solutions that offer the necessary protections.

How Fintechs Can Improve AML Compliance

By leveraging modern technology and maintaining close communication with regulators, fintechs can reduce risks and strengthen their operational resilience. Below are several key strategies fintechs can adopt to improve their AML compliance.

Adopt Advanced Technology

Artificial intelligence (AI) and machine learning (ML) can help fintechs more effectively identify suspicious activity. These technologies enable real-time monitoring and predictive analytics, allowing companies to detect abnormal transaction patterns and mitigate risks before they escalate.

Advanced AML fintech solutions can also automate compliance tasks, reducing manual errors while enhancing efficiency in flagging potential financial crimes.

Enhance KYB and Onboarding

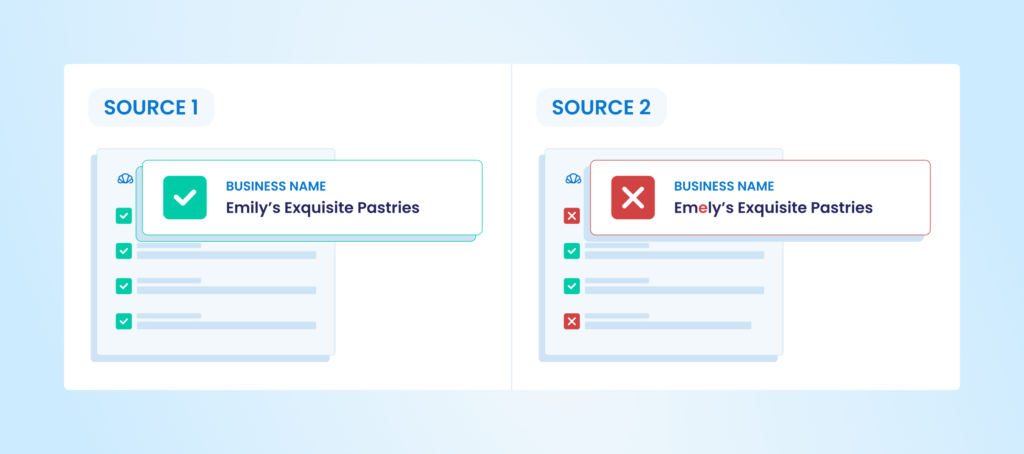

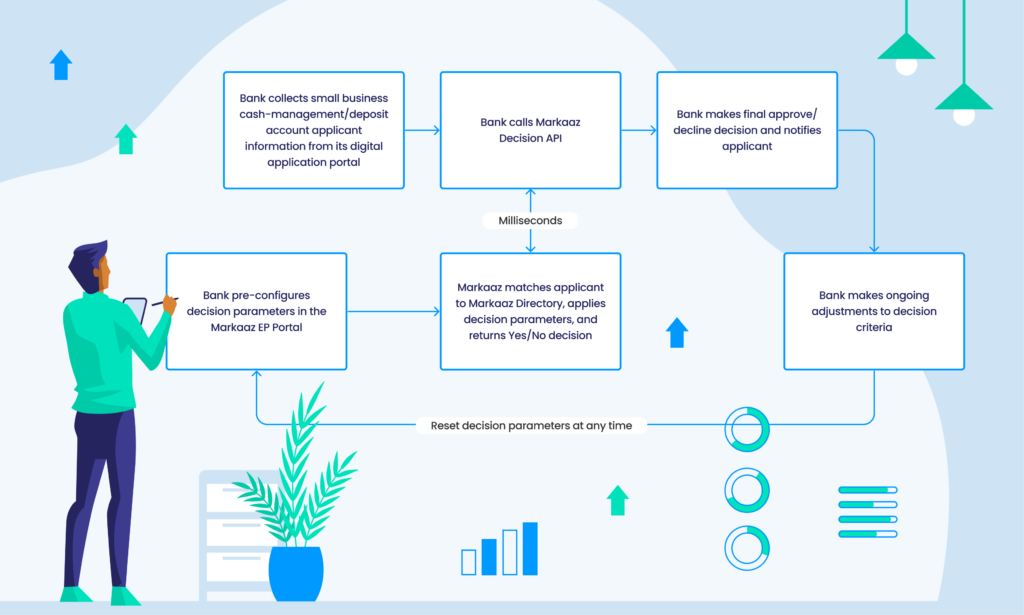

Utilizing B2B data solutions for business verification can help fintechs assess the legitimacy of the businesses they engage with. By automating the collection and validation of business information, companies can reduce onboarding time while ensuring compliance with AML standards.

Work Closely With Regulators

Building relationships with regulators helps companies better understand updates to compliance requirements and adapt their internal processes accordingly. Fintechs can benefit from staying on top of regulatory changes and taking a proactive approach to compliance.

Train and Upskill Staff

Forward-looking fintechs invest in training programs that educate staff on identifying suspicious activity. These programs teach teams how to stay compliant with regulations and effectively use advanced compliance tools. Well-trained employees are an integral part of any company’s compliance strategy, serving as the first line of defense for detecting and reporting potential risks.

Conduct Regular Audits and Compliance Checks

Conducting regular audits and internal compliance checks helps fintechs identify potential gaps in their AML framework. These audits ensure that systems and processes remain aligned with regulatory expectations. Additionally, external audits provide an extra layer of oversight, further reducing the risk of non-compliance penalties.

How Markaaz Can Help

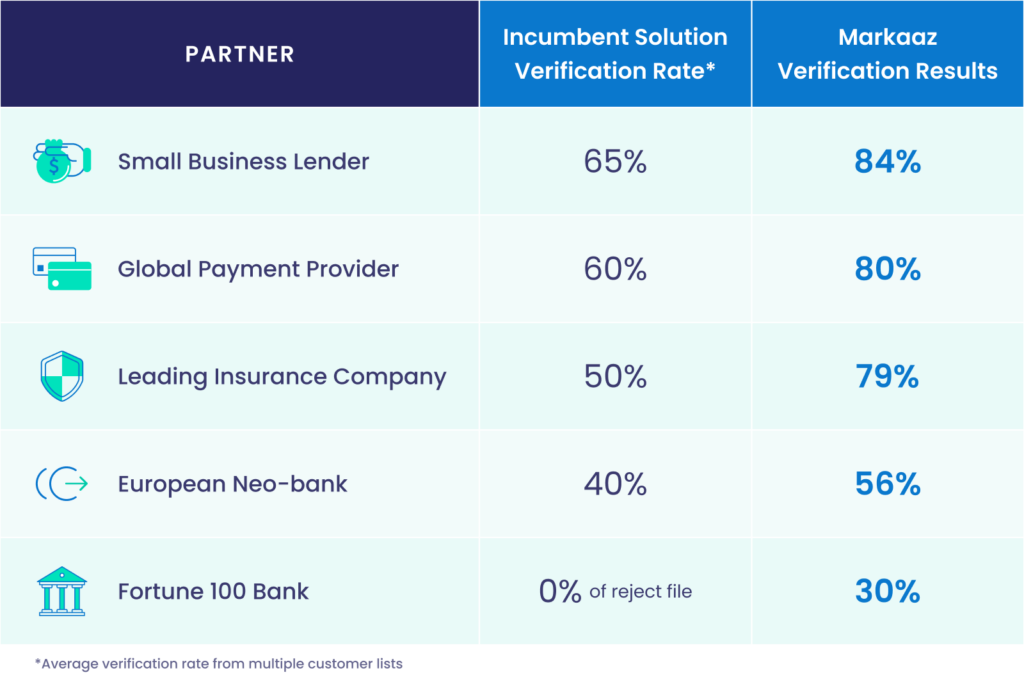

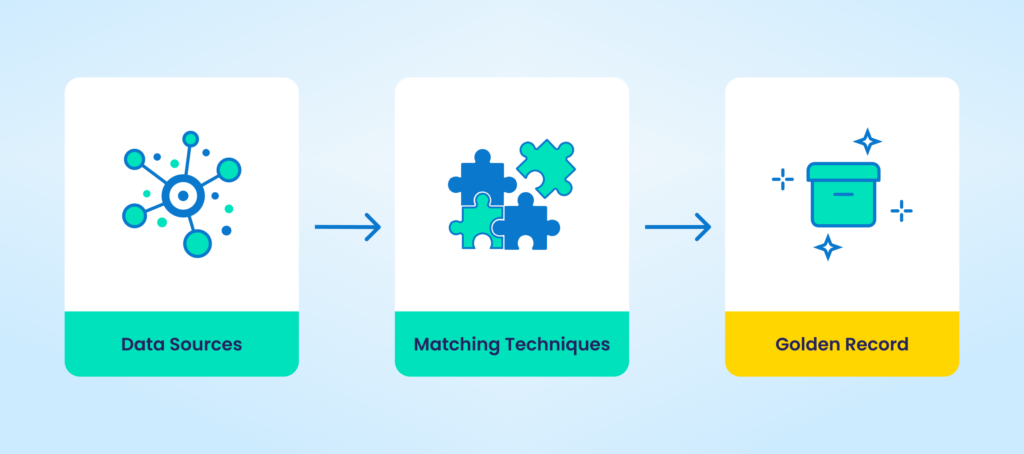

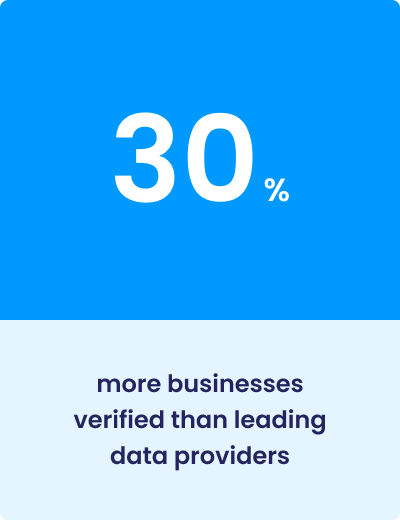

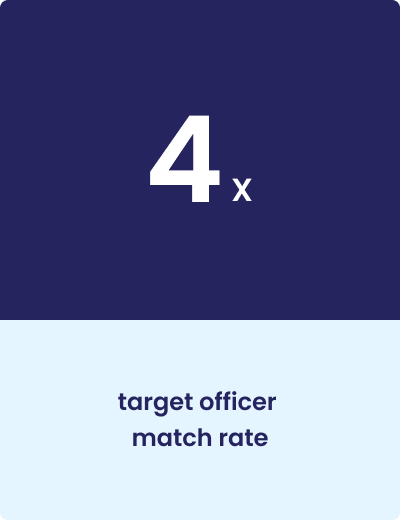

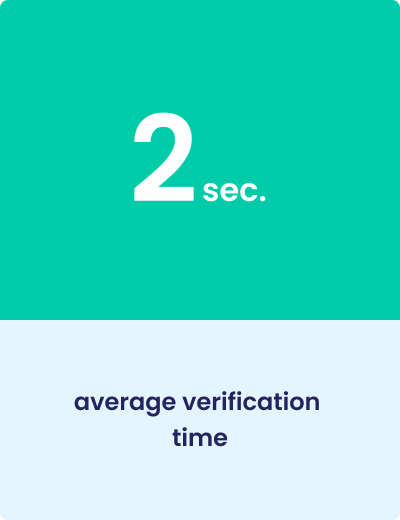

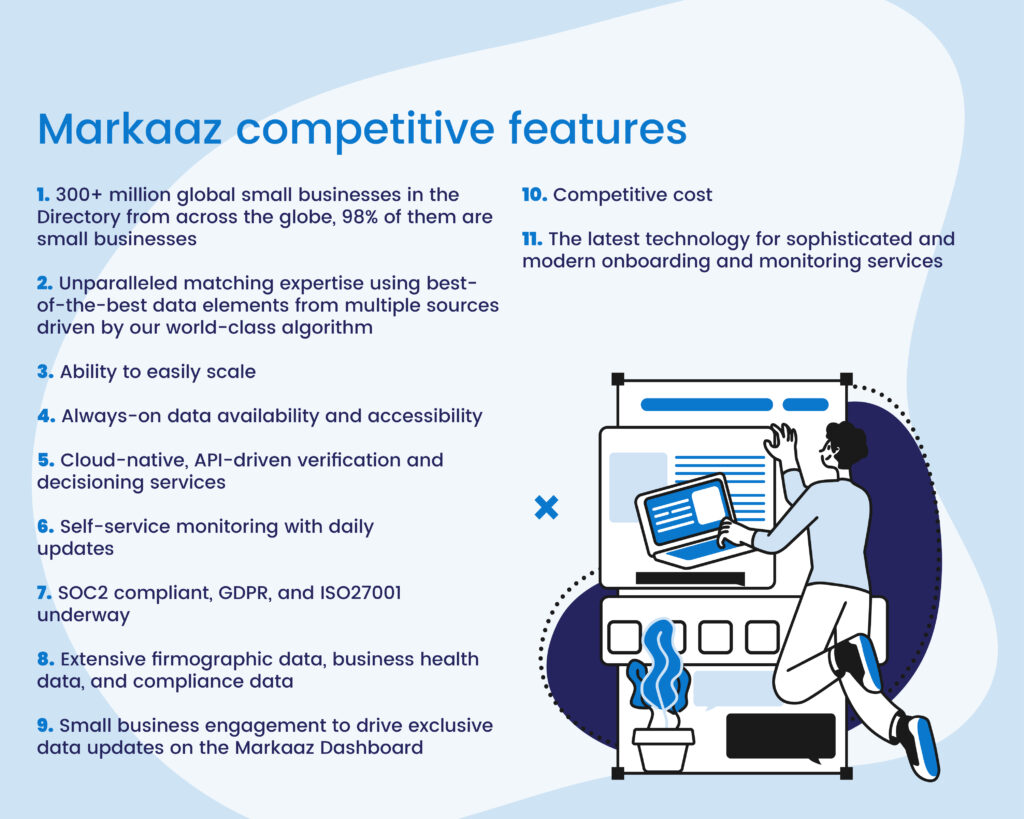

Markaaz is an industry-leading B2B data provider that empowers fintechs to stay ahead of compliance challenges by offering a comprehensive business verification platform that seamlessly integrates into existing AML and KYB processes.

By leveraging a global database of 519M business records from 65,000+ public and private sources, Markaaz delivers instant access to verified business information, including beneficial ownership details and AML compliance data. This helps ensure the fintech KYB process is accurate, efficient, and compliant.

Markaaz also streamlines transaction monitoring for fintechs, using AI-powered tools that cross-reference data in real time to identify suspicious activities. By automating these critical processes, Markaaz minimizes the risk of non-compliance, reduces false positives, and accelerates the onboarding process—allowing fintechs to operate with greater confidence in an increasingly regulated environment.

Connect with our team to learn how Markaaz’s comprehensive compliance solutions can simplify regulatory scrutiny, helping your fintech stay compliant while your teams focus on growth and innovation.